What is a "T-Account"?

2 min read•december 17, 2021

AP Macroeconomics 💶

99 resourcesSee Units

What is a "T-account"?

Quite simply, a T-account is a tool for analyzing a business's financial position through liabilities & assets. It's named for the T-shape that separates the data into two columns.

Check out these other AP Macro resources:

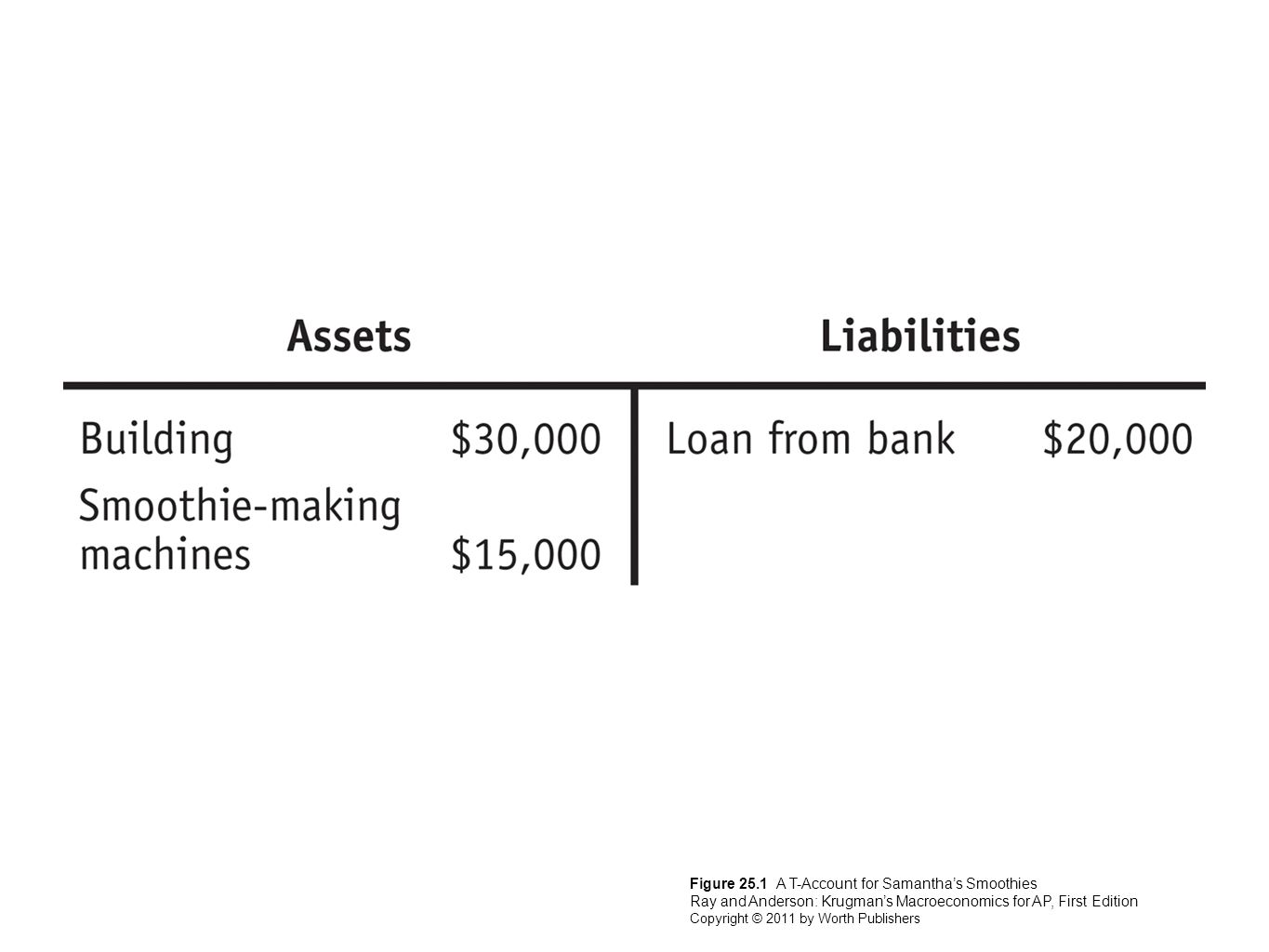

What does a T-account look like?

- this T-Account is for an individual business

- we always put assets on the left & liabilities on the right

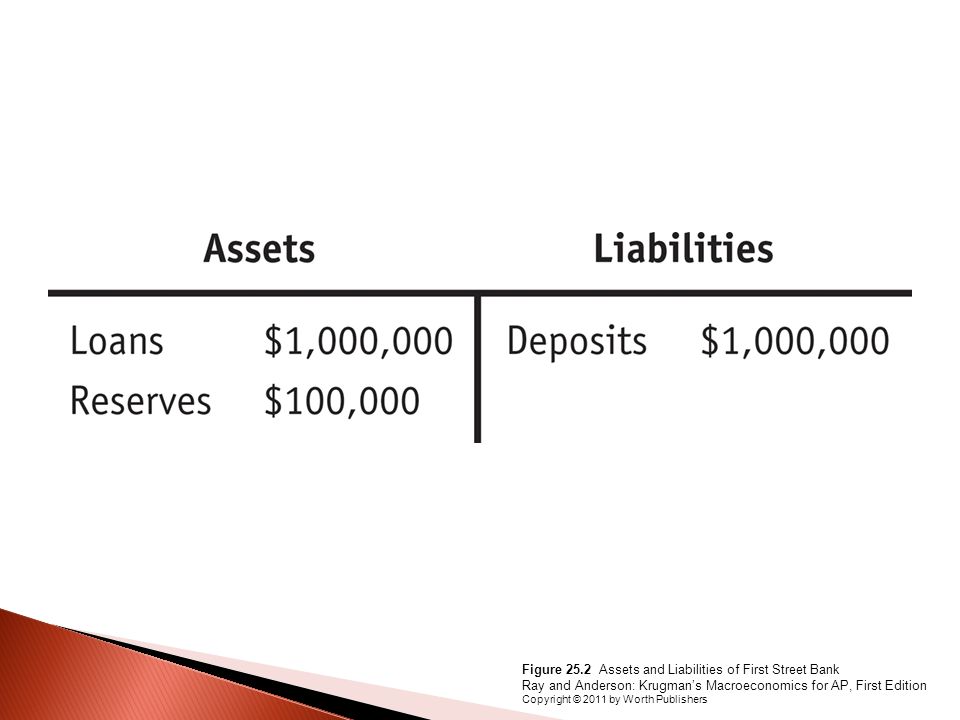

A bank can also have a T-Account, & it looks like this.

(They are also called Bank Balance Sheets)

Notice we have different terms than of an individual's T-account that corresponds to a bank's situation: loans, reserves, & deposits. There are 2 types of reserves: required and excess

- Required Reserves - The legal amount of deposits a bank MUST reserve, determined by the Fed - cannot be loaned out

- Excess Reserves - Any extra money reserved - can be loaned out

Practice Problem

- (a) What is the reserve requirement?

- (b) If David deposits $10,000 into the bank, how much will the money supply initially increase?

- (c) What is the maximum increase in the money supply after David's $10,000 deposit?

How do we utilize a T-Account?

- figuring out how much a bank can loan out or keep in reserves & therefore figuring overall how much the money supply has increased

- figuring out an individuals financial standing to find profits & losses

Answer to Practice Problem

- (a) The reserve requirement is 10%. Deposits are $1,000,000 and of that only $100,000, or 10% are reserved.

- (b) If David deposits $10,000, the money supply initially does not change! The money only changes composition.

- (c) Since we have a R.R. of 10%, the money multiplier is 1/0.1 = 10. 1000 dollars are required to be reserved, meaning 9000 can be loaned out. 9000 * 10 = $90,000 is the maximum increase in the money supply.

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

📝Exam Skills: MCQ/FRQ

© 2023 Fiveable Inc. All rights reserved.